Currency with public continues to swell in line with coronavirus lockdown extension

The Indian Express

May 11, 2020

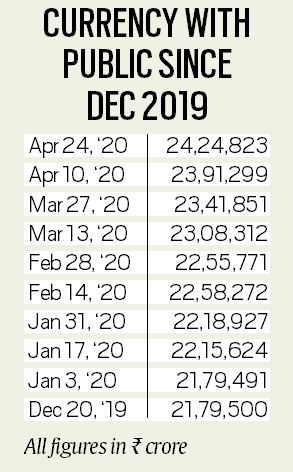

Currency in the hand of the public continued its surge for the fortnight ended April 24 as it rose by Rs 33,524 crore to hit a new high of Rs 24.28 lakh crore. With this, currency with the public — since the announcement of the lockdown — has gone up by Rs 82,972 crore. The rise in currency with the public comes despite appeals by the government and the RBI to use digital payment tools amidst the coronavirus outbreak.

With this, currency with the public has now increased by 15.9 per cent to Rs 3.32 lakh crore from April 2019. Simultaneously, banks have parked close to Rs 8.5 lakh crore with the Reserve Bank of India (RBI) at 3.75 per cent (reverse repo rate) and bank credit to the commercial sector declined by Rs 1,19,597 crore to Rs 109.19 lakh crore in March and April, indicating the unwillingness of banks to lend.

In fact, the currency in circulation has been rising sharply since the beginning of March when the virus started spreading across the United States and Europe, and fresh cases were also reported in India. RBI data shows that since February 28, currency with the public has jumped by Rs 1.69 lakh crore — or an average fortnightly increase of Rs 42,263 crore.

By comparison, in the 12-month period between March 1, 2019 and February 28, 2020, currency with the public had risen by Rs 2.28 lakh crore, or an average fortnightly increase of Rs 8,435 crore. Bankers say that while the announcement of the lockdown pushed the nation towards a more cash-driven economy, subsequent extensions to the lockdown and fresh rise in coronavirus cases will increase people’s reliance on cash and this may further go up.

A banking insider said that people have been withdrawing more and more cash and as the dependency on neighbourhood grocery stores has gone up, so has the requirement of cash. He, however, added that the pace of increase may go down. “As e-commerce platforms too have been allowed to deliver essential items, the pace of increase in currency with public will go down over the coming weeks,” he said.

In fact, the latest data shows a decline in the pace. While in the fortnight ended April 10, currency with the public rose by Rs 49,448 crore, in the fortnight ended April 24, it rose by Rs 33,524 crore.

According to the RBI, currency with the public is arrived at after deducting cash with banks from total currency in circulation. Currency in circulation refers to the cash or currency within a country that is physically used to conduct transactions between consumers and businesses.

According to banking experts, the rise in cash with the public indicates more usage of cash for transactional purposes. This may have also prompted more withdrawals at ATMs to support the same level of currency demand.

The RBI has been pushing for digital payments since the announcement of the lockdown, with RBI Governor Shaktikanta Das even coming on social media and TV channels with the campaign of “Pay digital, stay safe”.

Comments

Post a Comment